Examining the Effect of Oil Cost Modifications on Home Home Heating Expenses

The analysis of the influence of oil rate adjustments on home heating prices is an important location of study in the field of energy economics. By examining this connection, we can get beneficial understandings right into the monetary ramifications for property owners and explore potential plan procedures to alleviate the effect of oil price modifications on home heating expenses.

Historical Trends in Oil Rates

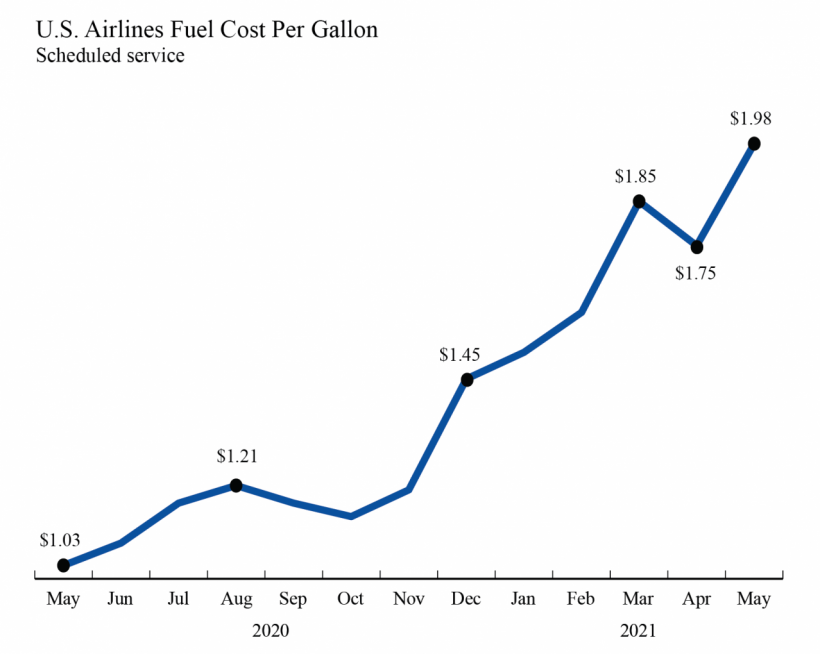

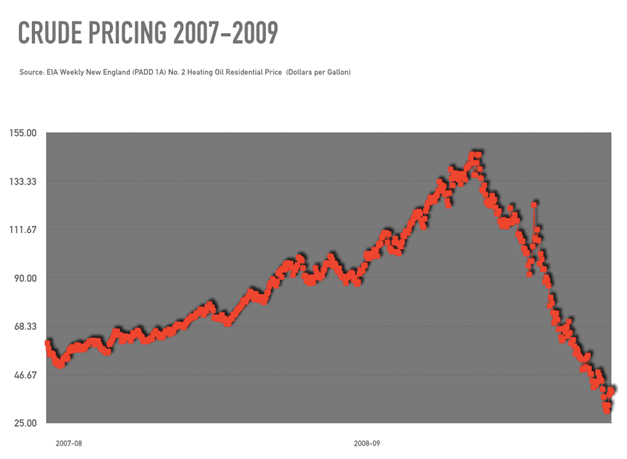

Over the past half a century, oil rates have actually experienced substantial variations, affecting the cost of home heating. Understanding the historical patterns in oil prices is essential for assessing the effect on home heating prices.

In the 1980s and 1990s, oil costs experienced a duration of family member stability. Technological advancements in oil extraction and production, such as overseas exploration and shale oil removal, added to a stable supply and assisted maintain rates in check. Nevertheless, occasional political tensions and disputes in oil-producing regions proceeded to influence oil prices periodically. oil prices long island.

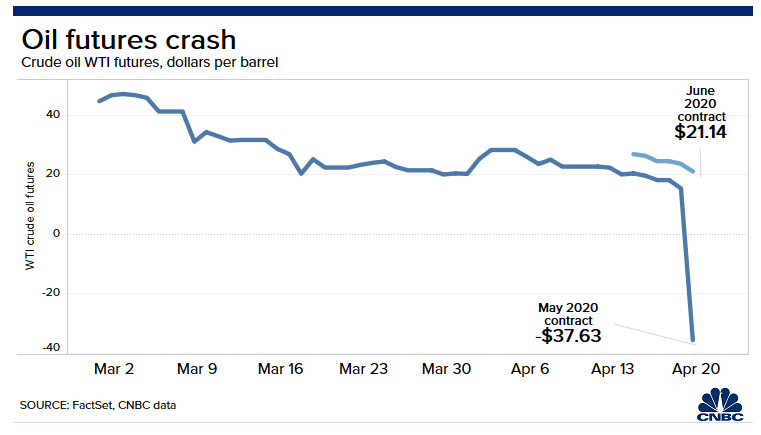

Since the very early 2000s, oil costs have undergone boosted volatility. The increase of emerging economies, specifically China and India, has actually caused a rise in international power demand, positioning upward stress on oil rates. Furthermore, geopolitical tensions in the center East, environmental policies, and currency changes have actually all added to the volatility in oil markets.

Aspects Affecting Oil Cost Fluctuations

Factors affecting oil price fluctuations consist of worldwide economic conditions, geopolitical events, and supply and demand dynamics. These elements add to the volatility and unpredictability of oil costs, impacting not only the power industry yet additionally numerous markets of the economy and customers' wallets.

Global financial problems play a significant function in oil rate variations. Economic growth and stability in major oil-consuming countries such as the USA, China, and India can result in boosted demand for oil, increasing rates. Conversely, financial recessions or downturns can bring about reduced need, triggering rates to fall.

Geopolitical events likewise have a considerable influence on oil rates. Political instability, conflicts, and assents in significant oil-producing regions such as the Center East can interfere with oil supply and produce uncertainty, bring about rate spikes. For example, tensions in the Persian Gulf region can interrupt the circulation of oil through the Strait of Hormuz, an important transportation factor for global oil deliveries.

Supply and demand characteristics are basic elements that influence oil costs. When supply surpasses demand, rates tend to drop, while when demand goes beyond supply, costs tend to rise. Factors such as manufacturing decisions by major oil-producing countries, adjustments in oil stocks, and interruptions in oil infrastructure can all affect the balance in between supply and need, creating price variations.

Recognizing these variables is vital for policymakers, power companies, and consumers to react and expect to oil rate modifications. By monitoring worldwide economic problems, geopolitical occasions, and supply and demand characteristics, stakeholders can much better take care of the influence of oil cost variations on home heating prices and other markets of the economy.

Understanding the Partnership Between Oil Rates and Heating Costs

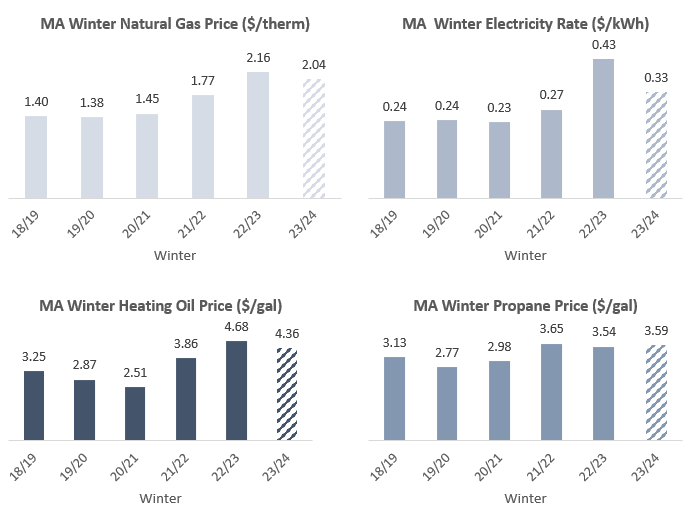

The partnership in between oil prices and home heating prices can be understood by taking a look at the influence of modifications in oil costs on the expense of home heating. Oil costs play a significant role in determining the Read Full Article quantity property owners pay to warm their homes during the winter months. When oil rates increase, the expense of heating oil likewise raises, which straight impacts the price of home heating. This is because home heating oil is stemmed from crude oil, and any variations in petroleum prices are shown in the price of home heating oil.

When oil costs are high, homeowners typically experience a spike in their home heating prices, as they require to buy a lot more pricey heating oil to keep their homes cozy. On the other hand, when oil prices are reduced, house owners profit from reduced home heating costs, as the price of home heating oil decreases. This relationship between oil prices and heating expenses is especially essential for homes that rely upon home heating oil as their primary source of warm.

It is critical for property owners to keep an eye on oil costs carefully, as modifications in oil prices can have a considerable influence on their regular monthly heating costs. By understanding the partnership in between oil prices and heating expenses, house owners can make educated decisions concerning their furnace and spending plan successfully for the winter season.

The Influence of Oil Price Changes on Property Owners' Budgets

.png?lang=en-US)

The effect of oil cost modifications on homeowners' spending plans extends beyond just the cost of home heating. Greater oil prices can likewise bring about increases in transport expenses, as fuel prices climb. This can have a plunging result on family budget plans, as transport expenses can consume right into discretionary revenue and limit the capacity to spend or conserve.

Policy Ramifications for Resolving the Effects of Oil Rate Adjustments on Home Home Heating Prices

To properly resolve the results of oil rate adjustments on home heating costs, policymakers have to consider different techniques and measures. By incentivizing homeowners to update their home heating systems to much more reliable alternatives, such as warmth pumps or solar panels, the general demand for home heating oil can be lowered.

One more approach is to branch out the energy resources used for home heating. Policymakers can motivate the use of different fuels, such as natural gas or biomass, which are less vulnerable to oil rate fluctuations (oil prices long island). This can be accomplished through tax incentives, gives, or subsidies for homeowners that pick to switch over to these alternate gas

Furthermore, policymakers can sustain research and advancement initiatives in renewable energy innovations. Buying technologies in the area of renewable home heating can lead to the advancement of environmentally friendly and affordable choices to oil-based furnace.

Lastly, policymakers need to think about applying income-based aid programs to aid low-income houses manage the impact of oil rate changes on their home heating costs. These programs can provide financial backing or subsidies to help counter the raised expenditures connected with higher oil rates.

Conclusion

Finally, analyzing the influence of oil price adjustments on home heating resource costs discloses historic patterns in oil prices and variables affecting changes. Recognizing the partnership in between oil costs and home heating costs enables a far better understanding of the influence view on homeowners' spending plans. Plan ramifications are necessary for addressing the results of oil cost changes on home heating expenses.

The partnership in between oil prices and home heating expenses can be recognized by examining the effect of adjustments in oil prices on the expense of home heating. When oil costs climb, the expense of heating oil likewise raises, which directly affects the expense of home heating.When oil prices are high, home owners typically experience a spike in their home heating prices, as they require to acquire much more expensive heating oil to keep their homes warm. On the other hand, when oil prices are low, home owners benefit from reduced heating expenses, as the rate of heating oil reduces.In final thought, analyzing the effect of oil rate adjustments on home heating prices exposes historic trends in oil rates and aspects affecting fluctuations.